Brokerages bullish on Vedanta’s prospects amid debt concerns

Market ETC...

February 29, 2024

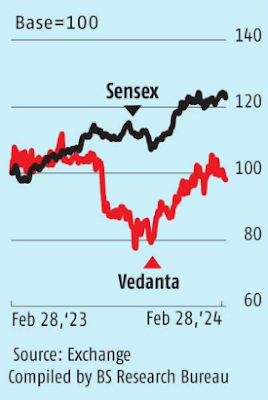

Mining conglomerate Vedanta has clarified the details of its complicated corporate reorg anisa ti on. The management shared its visionata recent investor meeting. The group has also outlined its plans to deleverage debtevenas it goes ahead with capital expenditure (capex) plans. Parent Vedanta Resources (OVRL) hasmanagedtocarryouta debt restructuring, raisingbonds in January 2024. As result, VRL'snet debt should reduce to $6.2 billion by the end of the current financial year (FY24) and according to management, debt should reduce to$3billion by FY27.The restructure has pushed the average maturityat VRLto2.5 years from theearlierlyear. Thishasresulted ina morebalanced riskstructure butthe cost of financingis higher. This residual debt would be servicedviabrandfeesand dividends from subsidiaries. The VRL cost of borrowing would be a keymonitorable inthe future. VRLs debtobligationsareabout $1.6-1.8billion in FY25and FY26. Listed Indian subsidiary Vedanta may pay a dividend pershare of340 inFY25and FY26,tohelp meet VRL’sdebtobligations. Vedanta willneed tomonetise thesteeland iron oreassets and this process, which is estimated toraise $2 billion, couldstartin Q1FY25.1In addition, the promoters can offload upto11.9 per centstake, retaining 50.1per centstake in Vedanta. Vedantaisundergoing major capex. Capex in the aluminium and zincbusinessesare scheduledtobe completed in FY25. Overall, Vedantais undertakinga $6 billion capex investment to increase capacitiesacross aluminium, zinc, ironore,oil and gas, steel,and ferrochrome. The group expectsto have apaybackonthetotal capex in about three yearswith an Ebitda potential of $2.5-3 billion per annumand incremental revenues of$6 billion per annum. Capex inaluminiumand zinc shouldresultin an incremental cash flow of $1 billion-plus per annumonce the plants ramp up fully, which could be in H2FY26. The guidance is for aluminiu Ebitda per tonne of $1,000 from end-FY26assumingan LME aluminium price of$2,350 per tonne. Overall, Vedanta’s FY25 Ebitdaistargeted to hit $5.6-5.7 billion, though conservative analysts may assume lower estimates. The existing company will be splitinto Vedanta Aluminium, Vedanta Oil and Gas, Vedanta Power, Vedanta Steel and Ferrous Materials, Vedanta Base Metalsand Vedanta tobe retained. The split intosixlisted vertical entities will be donebytheend-FY25assuming Sebi clearance. It’'s a proposed simplesplit, with investors receivinga single share ofeach of the five newentities foreveryshare heldin Vedanta. Thisreorganisation could unlockalotofvalue. In particular, it could enhance the power subsidiary’svaluations. Investors can focuson pure-play verticals and divest the businessestheyare notinterested in. The aluminium businesswillinclude the Lanjigarh refinery, Jharsugudasmelteranda SlpercentstakeinBalco.The power businessincludes 190mw TalwandiSabo Power, 600mw JharsugudaIPP, 1,000mw Meenakshi Energy and 1,200mw Athena. The Oiland Gasbusinessis theerstwhile Cairn Oil& Gas. The Steel&ferrous businessincludes SesalIron Ore, Sesa Coke, Liberia (ironore) and ESL Steel. The Base Metals vertical willhold Zinc International, Tuticorin Smelter, KCMand Fujairah Gold. Vedantawill continue tohold its 6492 per cent stakein listed Hindustan Zinc (HZL). The Aluminiumbusiness, HZL, and Cairn contribute around 67-70 per centofVedanta’s current revenue. Assteel capacity doubles, ESL’s revenue contribution should riseto 7 percentby FY26 (5percentin FY23). The debtrestructure, corporate reorganisation and capex plansalllook positive butthedebt overhang remains a cause for concern. According to Bloomberg, 5 of the10 analysts polled thisweek are bullish on the stock,3havea ‘reduce/sell’ rating, and one eachis ‘neutral’ and ‘not rated’. Their average one-year target priceis Rs299.44, indicatinga potential upside of about 14 per cent from current levels 0f 3262.80.

Most Popular

Tags

Search This Blog

About Me

Search This Blog

Search This Blog

Labels

- 'Axis Banks' profitability may moderate due

- 'Banks are catchingup

- " Doji Bullish " candel in stock market

- " Hammer " candel in stock market

- " Shooting star " candel

- "Doji" candel in stock market

- "Evening Star" candel

- "Morning Star" Candel

- "stock market bull candle."

- (IPO)

- $30b of Goods from India'

- 000 crore

- 186.65

- 2024 (Magazine)

- 428

- 431 INFRA PROJECTS HIT BY ₹4.8-TRILLION COST OVERRUN

- 500 crore through its second

- A breather for Paytm?

- A consortium backed by Mukesh Ambani’s Reliance Industries and India’s top engineering schools aim to launch its first ChatGPT-style service next month

- Adani Ports

- and signs are pointing towards alignment with central bank targets

- Anple

- Apple Dethrones Samsung

- ARCs' bad loan portfolio to touch Rs1.6 trn by FY25: CRISIL

- Asia will continue to stay on course with disinflation

- at $2.1billion in January

- Atlanta-based Novelis Inc

- AUTO MOTORS

- Bajaj Auto on Thursday said it has invested an additional ₹45.75 crore in electric bike-sharing platform Yulu Bikes. A PTI

- Bank

- Bank of Baroda on Wednesday raised 32

- Bankrupt airline Go First

- Banks

- Banks cede microfin ground to NBFCs

- Best Technology Bank award

- BJP banks on new

- BLOOMBERG

- Broking firm Angel One plans to raise ₹2

- BSE at odds with NSE over high clearing charges

- BSNL delays 4G launch to

- BUSINERSS

- BUSINESS

- Business India 5-Feb-2024 (Magazine)

- Central public-sector undertakings (CPSUs)

- Chola MS posts 100-crore profitin Q3

- commerce and industry minister Piyush Goyal said on Wednesday.

- CRISIL Mutual FUND PICK

- Dalal Street

- Deploy $5-10b in India

- Domestic MFs’ Gross Investments

- Drop OTP? Youll still need phone

- Easy ways to feel rich

- Economic and political 10-Feb-2024 (Magazine)

- Equity benchmark indices Sensex and Nifty broke their six-day winning run on Wednesday and settled with a steep fall amid fag-end selling triggered by arush for profit booking and mixed global cues.

- Eye Fresh KYC of Paytm

- Fintech major PhonePe on Wednesday announced the launch of its homegrown Indus Appstore specifically for the Indian market

- Flavourful controversies

- Foreign portfolio invesFtors’ (FPIs’)

- FPIs Sell Over Rs31-k cr Shares

- Funny video funny title for YouTube videos

- FY25 pegged 37%

- GADGETS

- German union callson

- Google Pushing WhatsApp Messaging

- Govt may tap PSBs for higher dividend

- Growth below nominal GDP

- has announced the first close of India Realty Excellence Fund VI (IREF V).

- has asked shareholders to vote on its related party transactions

- HDFC Bank

- here's a basic database schema for an online merch store:

- Higher

- HINDI NEWS

- How to earn money

- How to rich

- How to start Sip A Beginner's Guide

- If liquidity is short

- Impact 18-Feb-2024 (Magazine)

- Impact 25 FEBRUARY 2024 (Magazine) ADEX NOT IN FORM

- including GIC of Singapore

- Ind AS/IFRS implementation

- India becomes top

- India’s paints industry could turn into the proverbial red ocean

- Insights from four fund managers on the underlying PSU sector dynamics and trends

- Intraday trading

- Intraday treding

- IPL RUNNERS-UP IN LEAGUE OF BROADCASTING RIGHTS VALUE

- Jana SFB Q3 net profit rises 12.82% to ₹134.64 crore

- Join IEA PARIS:

- just 0.3% of market from 34%

- Kesoram Plans to Raise Funds

- Kolkata | Mumbai: Sovereign wealth funds

- Kotak Mahindra Bank rejigs mgmt;

- Lauggage Brands on

- Launching Your Own Business

- LG SINGNATURE OLED TRANSPARENT TV exhibit 1-Feb-2024 (Magazine)

- Lift Bank Profits in Q3

- Loan against property:

- Long time investment

- M&M net profit zooms 4%

- Magazines

- MARKET ETC

- Market gained for the fifth consecutive session on positive global cues taking Nifty-50 to new high of 22

- market growth

- market; retail cedes share

- MARKETS

- MARKETS REGULATOR SEBI

- matching retail trend

- MFs ₹13K BALM AS FPIs

- MFs investor

- Mkt rebounds

- Motilal Oswal Alternates

- Mukta 1-Feb-2024 (Magazine)

- Mumbai: The Reserve Bank of India (RBI) will meet banks to sort out the grey areas in overseas investment (OI)

- Mutual Fund Insight 1-March-2024

- Mutual Funds

- Mutual funds (MFs) pared their holdings in Zee

- New Delhi: India negotiates its trade pacts with fairness and open mind and takes care of the interest of people

- Nifty 50

- Nifty 50 22055 0.64 S&P sensex 72623

- Nifty reclaims 22K level

- Nirmala Sitharaman

- Northern

- NSE to double

- OUTWARD REMITTANCESunder the Reserve Bank of India’s (RBI) Liberalised Remittance Scheme (LRS) registered

- PayPal toreduce

- Paytm

- Paytm (RBI) ordered its termination by February 29

- PAYTM APP MAY LOSE ACCESS

- Paytm bank: Das RBI governor

- Paytm downloads

- Paytm Payments Bank

- Paytm PB curbs may have limited impact 90%

- Paytm readies advisory panel; RFP for auditors

- paytm storm

- Paytm...

- Paytm's Talent Pool

- PhonePe

- PNB’s upsides

- Poll bond disclosures:

- private equity funds and global infrastructure asset managers

- PTI

- PTl

- Punjab Govt Pays Banks

- RBI

- RBI asks banks

- RBI conducts 2 VRR

- RBI directs card network

- RBI leaves

- RBI lets Paytm Payments Bank users

- RBI restrains

- RBI to bank chiefs

- RBI’'s DPIjumpsto418.77 in Sept 23

- Retail inflation eased to a 3-month low of 5.1%

- Revanth govt. to give LPG refill for 500 and free power soon

- Rupee hits over 5-month closing high THE INDIAN RUPEE rose on Thursday

- S&P BSE Sensex Nifty 100

- said Reserve Bank of India (RBI) READ...

- SBI Mutual Fund's

- SBI seekinglower CRR

- SENSEX

- Sensex at ris

- Sensex dips 1% on policy

- SENSEX SLIPS 723.5 POINTS TO 71

- Sensex still 620 points shy of record close

- SIP Info

- SolarQuarter 1-Dec-2023 - India Maharashtra’s Shirdi Temple Releases Tender For 1 MW Rooftop Solar Installation Railways Open Bidding for 1 MW Rooftop Solar Ventures In Assam

- SpiceJet fund infusion

- Sportstar 2-March-2024 (Magazine)

- STOCK MARKE

- STOCK MARKET

- Stock market one time investment

- STOCKS IN THE NEWS

- Sure

- Swiggy may soon file

- TaMo Cuts Prices

- Tata Capital

- Tech snag delays

- Tesla pay

- the alternative investments arm of Motilal Oswal Financial Services

- The cost of a crisis

- the financial services arm of the Tata group

- The Financial Stability and Development Council (FSDC)

- The NSE benchmark Nifty 50 recovered

- The Reserve Bank of T India (RBI) became a net

- The stock market’s T engines may have more steam left despite Nifty’s new peak fuelling

- The World Bank's lending arm and other global institutions have issued $1.4 billion

- THE WORLD BANK'S lending arm and other global institutions have issued $1.4 billion worth of offshore rupee-denominated bonds so far this year to meet strong demand spurred by India's

- THE ZEE ENTERTAINMENT stock crashed 15% on the Bombay Stock Exchange

- Thrust on Letting Economy Grow

- Time 16-Feb-2024 (Magazine)

- Too many IITSs lead to unrealistic expectations and quality problems

- Top Broker Bodies Differ Over Planto Extend Trading Hours

- touching3 Rs164.50at the end of Wednesday’s trade

- TRAVELBIZ MONITOR 1- FEBRUARY

- Trump Defeats Haley in

- US chocolate market

- vendorsforsolar PLI scheme

- Women are yet to be seen as legitimate music creators: Lisa

- Yellow fever

- Yes Bank is set to recover 50%

- YouTube description

- इरडाई बरकरार रखता है बीमा नियामक और विकास प्राधिकरण (आईआरडीए) शुक्रवार को

- क्या आप एकाधिक घर ले सकते हैं एक ही समय में loans ? क्या कोई व्यक्ति एक से अधिक loans

- व्यक्ति ने कहा कि बायजू के प्रति सहानुभूति रखने

Leader in automobile manufacturing

March 07, 2024

Understanding Lifestyle

September 05, 2023

Sensex peaks 74,000 for the first time, Nifty nears 22,500

March 07, 2024

MFs offload PSB stocks, betbig on private banks

April 24, 2024

0 Comments