HYUNDAIMOTOR’S INDIA LISTING expected to weigh on Japanese co’s valuation premium as battle shifts to EV share

Ruchita.Sonawane

@timesgroup.com

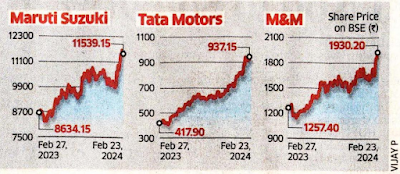

Mumbai: Maruti Suzuki’s continued dominance on Dalal Street as investors’ most preferred domestic automobile maker faces challenges with rival Hyundai Motor preparing for a debut on Indian bourses. The South Korean car maker’s listing in the country could weigh on the premium valu at ions that Maruti’s shares enjoyed over other auto companies so far, said fund managers and analysts. Hyundai, according to an ET report earlier this month, is in discussions with bankers for an initial public offering (IPO) here but the timing and size of the share sale is yetto beascer tained. Although market participants await Hyundai’s IPO prospectus to understand its numbers better, the initial assessment is that the company’s aggressive push into select high-growth segments might give investors more options in the sector. “The degrowth in the small car segment and lack of EV products reduce growth prospects while indicating adverse impact on Maruti’s share price,” said Ashwin Patil, senior auto analyst PR at LKP Securities. While “Post Hyundai’s Hyundaiis listing, the negatiyet to file ve impact on Maru papers for ti’s share price canits IPO, the not beruled out.” primary Hyundai is projecpurpose of ted to sell 785,488 the listingis vehicles in FY24, to expan dits while Maruti’s to EV portfolio tal volumes are estimated at 20,85,637 units. Though Maruti sells more cars, brokerage Emkay Global said Hyundai’s profitability growth has been much sharper, given its relatively premium positioning. Fund managerssaid that Maruti’s

shares could extend gains in the near term but Hyundai stands to benefit from the more profitable growth areas. “Maruti shares are likely to witness a 7-8% up move from current levels, however, Hyundai is better positioned in the mid-to-premium segment and can benefit from electric vehicle (EV)leverage,” said Niket Shah, fund manager at Motilal Oswal AMC. Maruti is likely to be re-rated around the time of Hyundai’s listing but eventually Hyundai is expected to be at premium valuations, Shah added. Since the news of Hyundai’s listing plans surfaced in the first week of February, Maruti shares have gained10.5%. They have gained 12% so far in 2024 and 33% in the past year. “Maruti at current levels is overpriced and trading at high multiples,” said Patil. “Hyundai’s valuations are like lyof Maruti and Mahindra & Mahindra, offering investors a better bet and could lead to adverse impacton Maruti’s valuations.” According to Emkay, Maruti is trading at a price-to-earnings ratio of nearly 25 times FY26 estimated earnings. Some think Hyundai’s listing could impact the share valuations of Tata Motors and Mahindra more than Maruti’s. “The primary purpose of the IPO is for expansion of Hyundai’s EV portfolio, but Maruti isn’t actively looking at the EV segment,” said Dharan Shah, founder of Tradono my Research. “This implies that Hyundai’s actual competition is likely to be with Mahindra & Mahindra and Tata Motors.” Tradonomy’s Shah said Hyundai is more likely to eat into M&M’s market shares in ceit is the smallest company in terms of market capitalisation compared to Tata Motors and Maruti.

0 Comments